TL;DR

By linking people data (FTEs, utilisation, realisation) to a rolling P&L, a 1,000-staff services firm redistributed capacity and tightened pricing discipline, boosting recovery by 8% and minimising forecast surprises.

Key takeaways

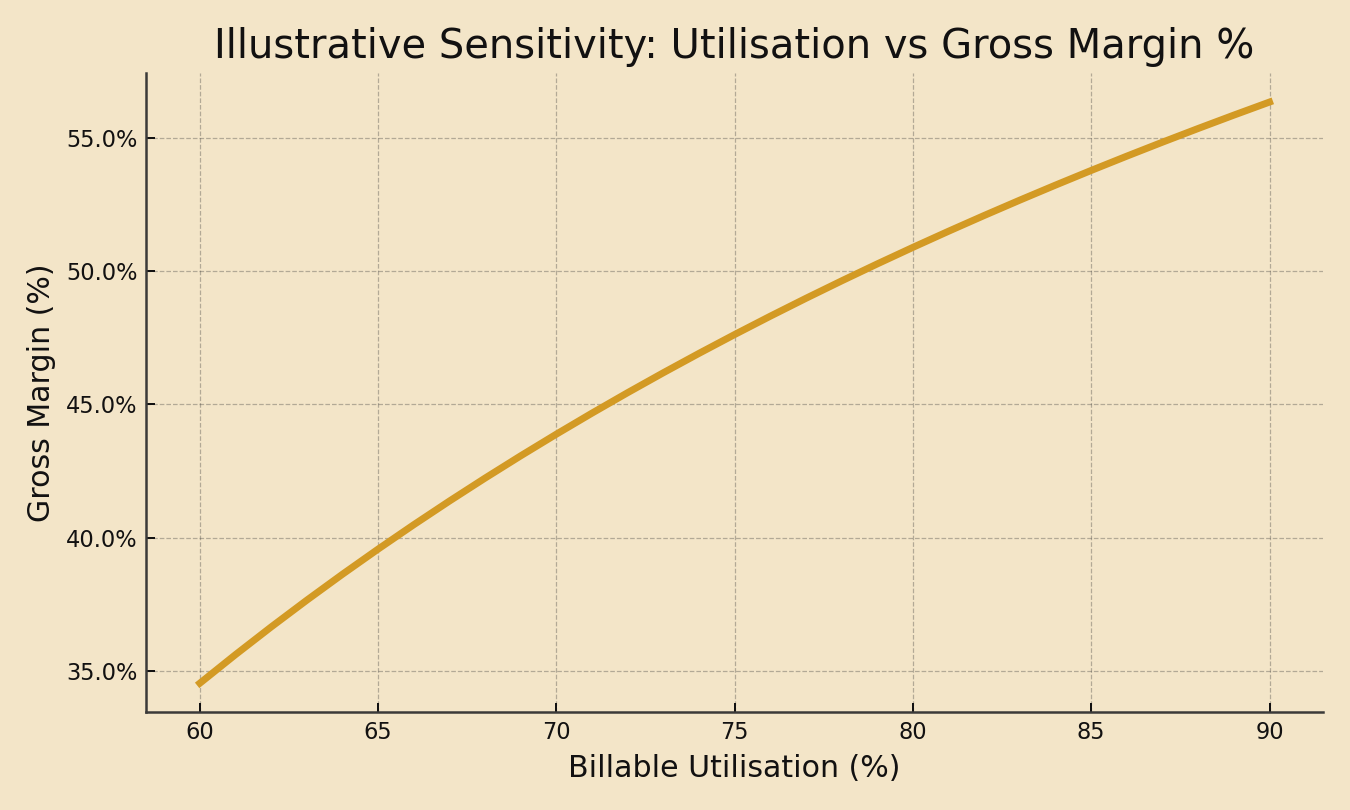

- Small shifts in utilisation and realisation move margin disproportionately.

- A rolling forecast turns reporting into action.

- Quote discipline + scope hygiene reduce hidden write-downs.

- Rebalance capacity before hiring.

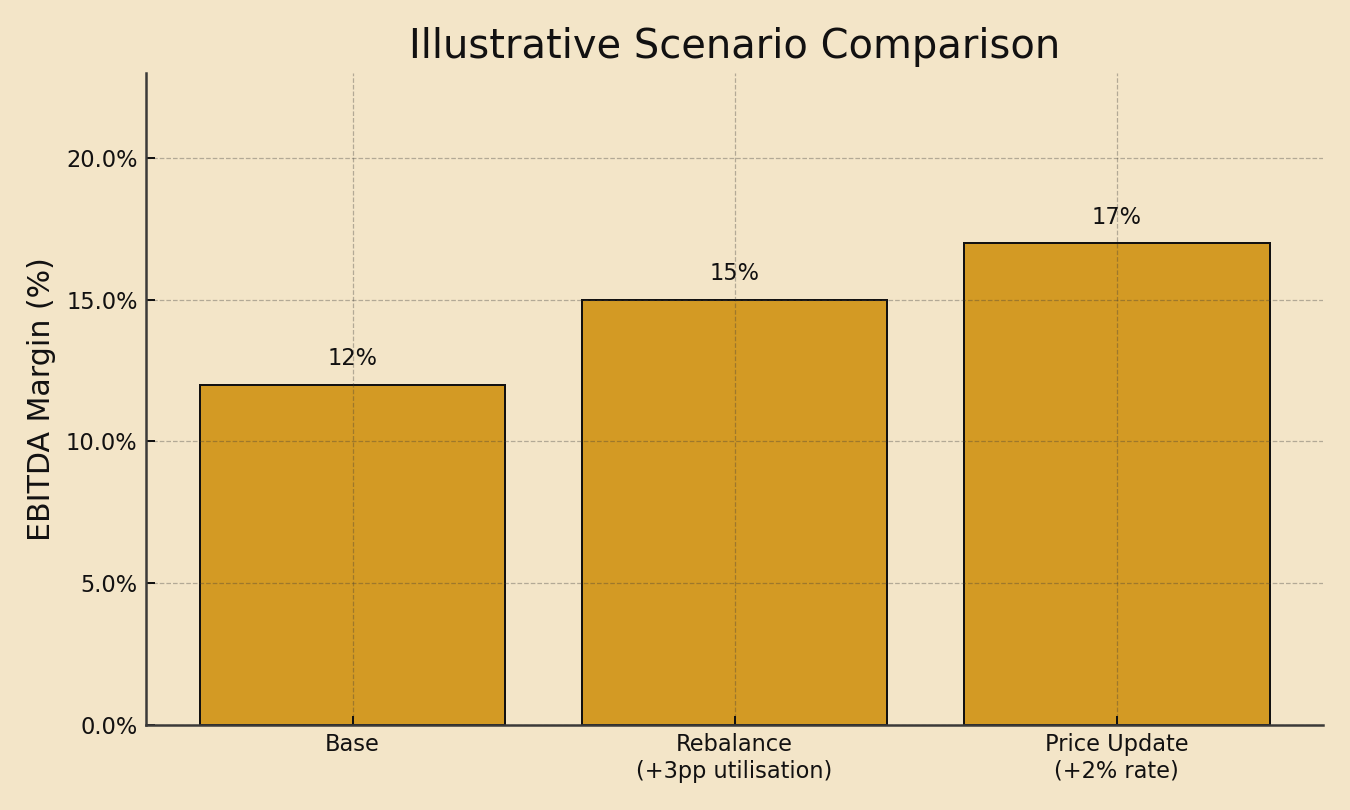

- Give managers the levers (+2% rate, ±3pp utilisation) in simple views.

The challenge

- No unified view from staff plan → P&L.

- Pockets of over/under-capacity across business units.

- Discounts/write-downs eroded margin without an early signal.

- Finance reported accurately after month-end; managers needed forward insight.

Executive objectives

- Protect margin during growth: Staff at the right time, in the right units.

- Make discounts visible: Convert “silent write-downs” into transparent realisation decisions.

- Enable managers: Put the levers (utilisation, rates, mix) in the hands of BU leaders.

- Shorten the cycle: Move decisions in period via a rolling forecast not post-month-end.

Our approach

- Workforce model tied to P&L: headcount, start dates, ramp-up and leave phasing; role-based utilisation targets (e.g., producers 75—80%, managers 35—50%1).

- Surface the levers: KPIs (Utilisation, Realisation, Rev/FTE, GM%, EBITDA%), and instant what-ifs (rate ±2%, utilisation ±3pp). Rolling forecasts enable faster, continuous decisions23.

- Pricing governance: realisation checkpoints at quote/approval; clear guardrails on discounts. Realisation = share of standard billable value actually billed/collected4.

- Enable managers: capacity-vs-demand view by BU with alerts.

Methodology & model design (how it actually works)

1) Staffing engine

- Inputs: Planned FTEs by role, start dates, vacancy lead-times, ramp-up curves (e.g., 60% → 80% → 100% over first three months), and leave phasing (annualised days distributed by month).

- Calendarisation: 52-week calendar rolling forward 12—18 months; public-holiday overlay by region.

- Outputs: Available hours and billable capacity by role/BU/month.

2) Utilisation & realisation layer

- Utilisation targets by role (e.g., Consultant 78%, Senior 76%, Manager 45%). Targets can vary by BU seasonality.

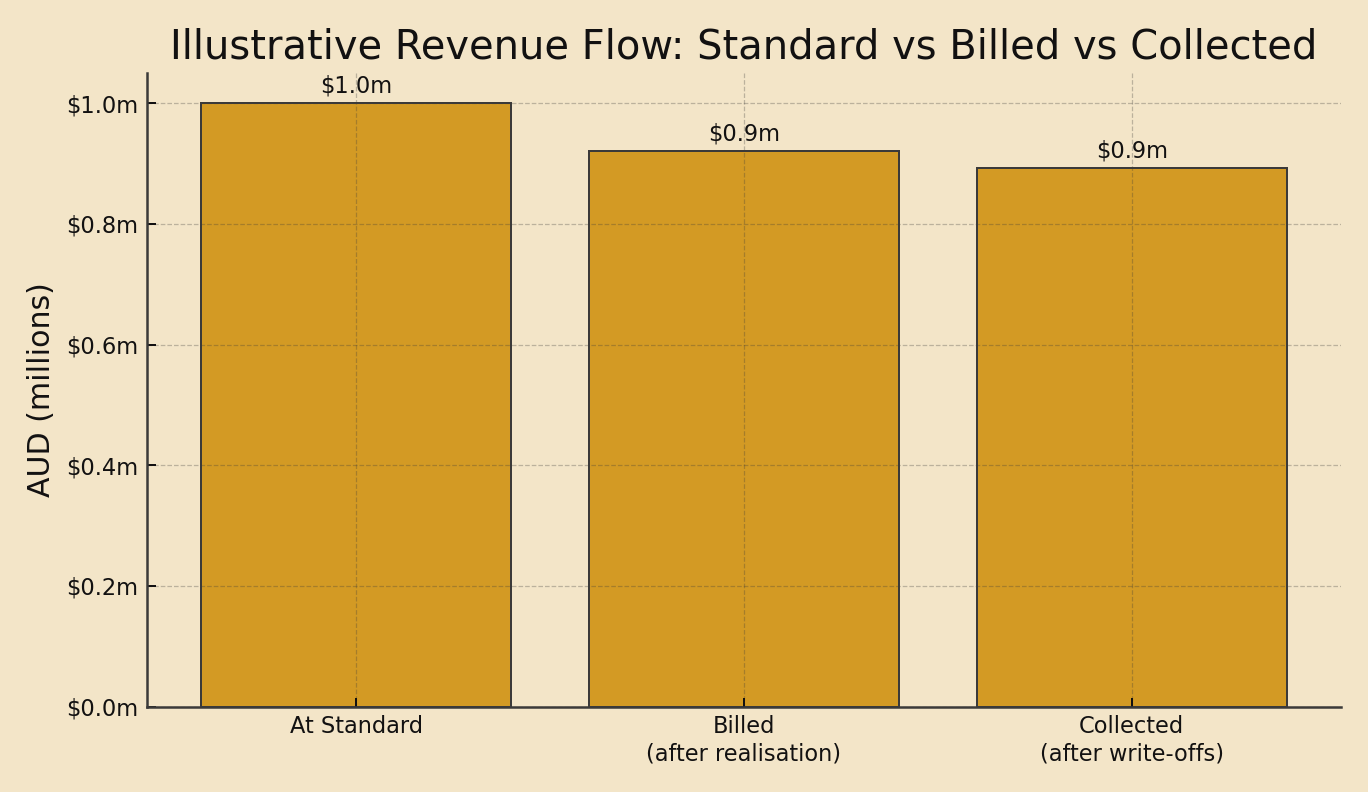

- Realisation (recovery): Standard rate × hours → standard value → apply discount/write‑down policy to project billed value, then collections to get collected value.

3) P&L integration

- Revenue:

Collected = Hours × Rate × Realisation × Collection% - Direct cost: Fully loaded salaries (incl. super/benefits), contractors, overtime, bonus accruals.

- Gross margin:

GM% = (Revenue − Direct Cost) ÷ Revenue - EBITDA:

EBITDA = GM − Overheads(non‑people overheads phased to known run‑rates).

4) Data sources

- HRIS for positions/FTE and start dates; PSA/timekeeping for hours; ERP/GL for costs; CRM for pipeline. (Automate later CSV import works on day one.)

KPI formulas & plain‑English examples

- Utilisation (billable) = Billable hours / Available hours. Example: 30 ÷ 40 = 75%.

- Realisation (recovery) = Billed value / Standard value. Example: $92k ÷ $100k = 92%.

- Revenue per FTE = Revenue / FTEs. Example: $5.0m ÷ 25 = $200k/FTE.

- Gross Margin % = (Revenue − Direct cost) ÷ Revenue.

- EBITDA % = EBITDA ÷ Revenue.

Figure 1 Utilisation vs Gross Margin % (illustrative)

Figure notes: Assumptions for a single FTE: 1,800 hours/year, $220/hr standard, 90% realisation, $140k fully loaded salary. Purpose: small utilisation lifts can materially increase GM% when people costs are semi-fixed in-period.

Figure 2 Revenue Flow: Standard → Billed → Collected (illustrative)

Figure notes: Shows how realisation and collections shape final revenue. Definitions per AccountingTools4.

Figure 3 Scenario Comparison (EBITDA %; illustrative)

Figure notes: Illustrates impact of (+3pp utilisation) and (+2% rate). Quantify with your live model by BU.

Pricing & realisation playbook (what managers actually do)

- Quote discipline: Surface a floor rate per role (cost + target GM%). If a quote goes below floor, approval is required.

- Scope hygiene: Lock scope statements in the PSA; changes create visible deltas not silent write-downs.

- Mid-sprint WIP review: For projects at ‰¤85% realisation by mid-month, require a recovery action (scope adjust, price change, or timeline).

- Close-out checklist: Confirm write-downs by reason code to drive coaching (estimation, client change, internal rework).

Capacity rebalancing framework

- Traffic lights per BU: Under-utilised < 72% (green for growth), 72—78% (amber), >78% (red: watch burnout). Targets vary by role tune to your context.

- Actions: Shift pipeline, cross-staff, accelerate starts, or pause recruitment. Tie to rolling forecast so moves update the P&L instantly.

Scenario catalogue (start with five)

- S1 Demand shock (−5% hours) → watch utilisation & staffing lag.

- S2 Price update (+2% rate) → expected uplift to GM% & EBITDA%.

- S3 Mix shift (more senior time) → higher rates but potential realisation risk.

- S4 Cost inflation (+3% salaries) → wage drag; test price pass‑through.

- S5 Hiring lag (+1 month starts) → near‑term margin support vs growth delay.

Operating rhythm (who meets when, about what)

- Weekly (Managers + Finance partner): Capacity vs demand, at-risk projects (realisation), upcoming quotes vs rate floors.

- Monthly (ELT): Scenario deltas, hiring plan updates, rate/discount policy changes, overhead runway.

- Quarterly (Board/Owners): Strategic bets, BU performance distribution, benchmark gaps, client concentration.

Change management & adoption

- Enablement: 45-minute live demo + quick-reference guide for each role.

- Guardrails: One-page discount policy with 3 examples (allowed / exception / no-go).

- Coaching: Monthly review of write-down reasons; celebrate turnarounds publicly.

- Incentives: Align variable comp to balanced KPIs (realisation + client satisfaction), not just billable hours.

Results deep-dive

| Metric | Before | After | Comment |

|---|---|---|---|

| Utilisation (billable) | 74% | 77% | Rebalanced capacity across BUs |

| Forecast cycle time | 10 days | 4 days | Automation + standardised drivers |

| Forecast accuracy (MAPE) | 11.8% | 7.2% | Weekly driver reviews + rolling window |

| Stakeholder satisfaction | 6.5/10 | 8.4/10 | Clear cadence & TL;DR insights |

Lessons for different audiences

- Executives: Treat utilisation/realisation as strategic levers small moves matter.

- Commercial managers: Your day-to-day actions (quotes, staffing, scope) drive the P&L.

- Analysts / early-career FP&A: Focus on bridge stories (what moved and why), not just variance tables.

FAQ (for non‑finance readers)

- Why do small utilisation changes matter so much? People costs are mostly fixed in the short term; tiny shifts change revenue without changing cost.

- Is realisation just “discounting”? It includes discounts and write‑downs from scope creep, rework, or billing policy.

- Why a rolling forecast? Because demand, pricing and hiring move faster than an annual budget-rolling updates keep decisions current.

Glossary (plain English)

- FP&A: Financial Planning & Analysis: planning, forecasting and decision support.

- FTE: Full-Time Equivalent: 1.0 = one full-time person.

- Utilisation (billable): Share of time spent on client-billable work. Typical role targets vary1.

- Realisation (Recovery): Share of standard billable value actually billed & collected4.

- KPI: Key Performance Indicator, a core metric to track performance.

- EBITDA: Earnings before Interest, Tax, Depreciation and Amortisation, a proxy for operating profit.

- Rolling forecast: A continuously updated forecast horizon (e.g., always 12—18 months ahead)2.

Sources & further reading

See it in action

Want a 15-minute walk-through of how utilisation & realisation flow into your P&L?

Footnotes

-

Role‑based utilisation targets: Scoro, “Billable Utilization: Formula, Benchmarks & How to Increase It” (Feb 19, 2025). Producers 75–80%; Managers 35–50%. ↩ ↩2

-

Rolling forecast definition: AICPA & CIMA, “Rolling Plans and Forecasts” (CIMA Official Terminology). ↩ ↩2

-

FP&A agility & practices: McKinsey, “Advanced FP&A practices for a volatile macroeconomic and business environment” (Jul 18, 2024). ↩

-

Realisation definition: AccountingTools, “Realization rate definition” (Jan 4, 2025). ↩ ↩2 ↩3